Identity management

Comply with local regulations for swift and secure digital customer onboarding

eKYC (electronic Know-Your-Customer) is a remote process of verifying digitally the identity of customers to safeguard financial institutions / intermediaries from risks such as identity frauds and money laundering activities.

Combat Threats Today!

Tradelink shared the importance of 2nd ID document in eKYC processes for identity verification at the Fraud and Money Laundering Intelligence Taskforce (FMLIT) Training Seminar organised by the Commercial Crime Bureau on 29 Nov 2024. Contact us to receive insights and a report on the presentation.

Learn moreGet report

How Tradelink's eKYC solution works

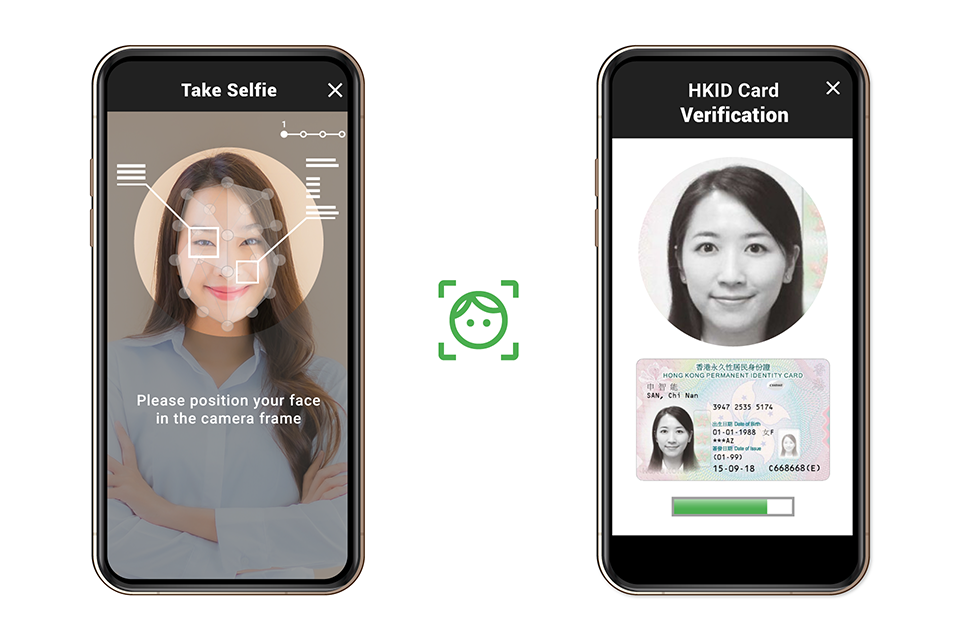

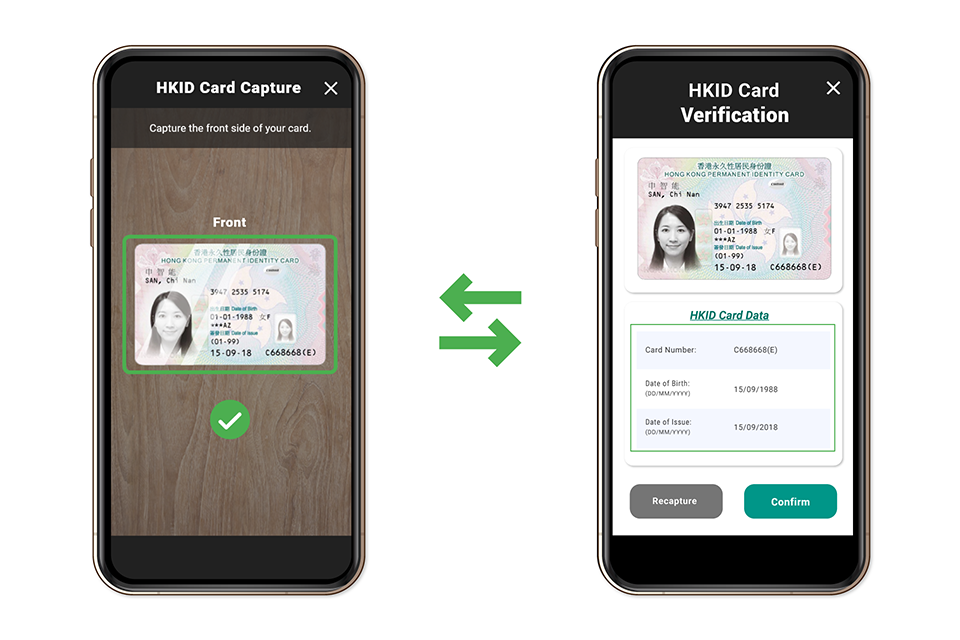

Capture Identity Document and Take Selfie

- With our unique angle-free capturing feature which allows user to capture ID document in a way that can avoid glare and shadows for easier capturing and enhanced OCR accuracy

- Selfie for liveness detection by eye blink with random timer

Data Sent to Client's Backend for Identification Process

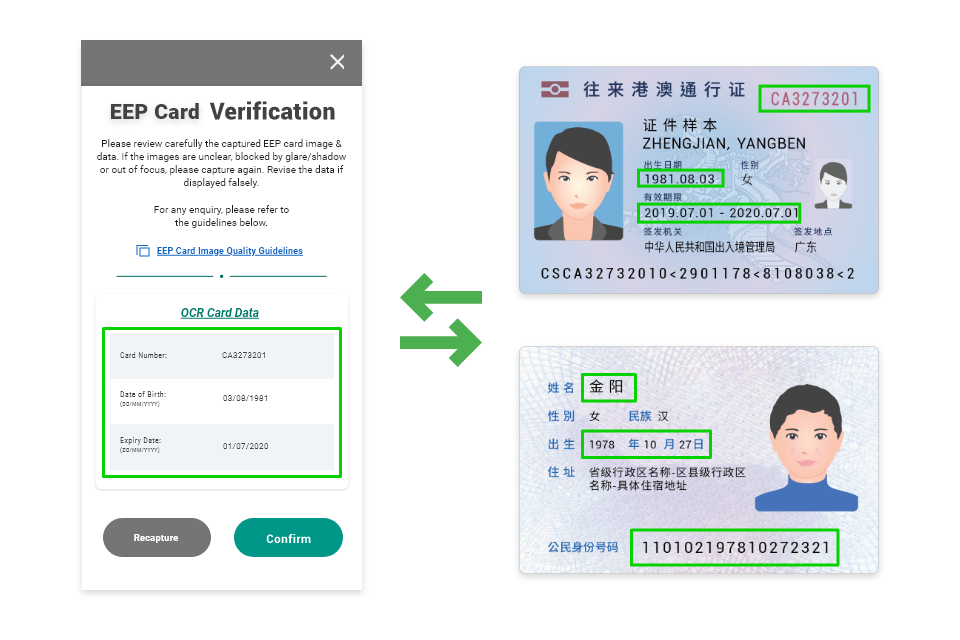

- Anti-forgery checking to validate security features of ID documents captured

- Additional data logical checking including digit verification, Chinese commercial code (CCC), English name alphabet and symbol checking

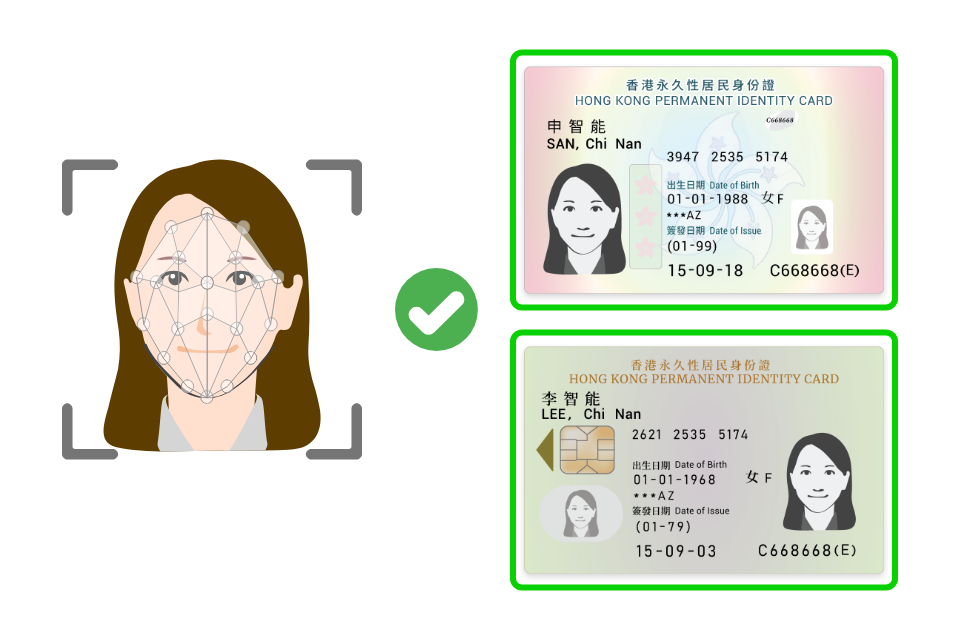

- Facial recognition to compare and validate the similarity of ID document portrait and selfie image

- Advance facial feature analysis which provides detailed and nuanced insights based on visual analysis of the subject’s selfie image

Identity document(s) supported

Hong Kong ID Card

(2003 & 2018 versions)

Exit-Entry Permit for Travelling to and from Hong Kong and Macau (EEP) and China ID Card

e-Passports

(ICAO standards)

Features:

- On-premises or cloud-based solutions as option for implementation

- Can be integrated and deployed in a mobile application and self-service kiosk

Benefits:

- Enables customer to open account on his / her own device anytime, anywhere with convenience

- Enhances customer experience by providing a seamless account opening process

- Shortens the KYC processing time from days to few minutes

- Reduces customer acquisition costs