Electronic Know-Your-Customer ("eKYC") solution

for an e-wallet operator for digital onboarding of its customers

|

With our proven record and experience in providing compliant eKYC solutions, we have received a new order from an e-wallet operator to use our solution for digital onboarding of its customers.

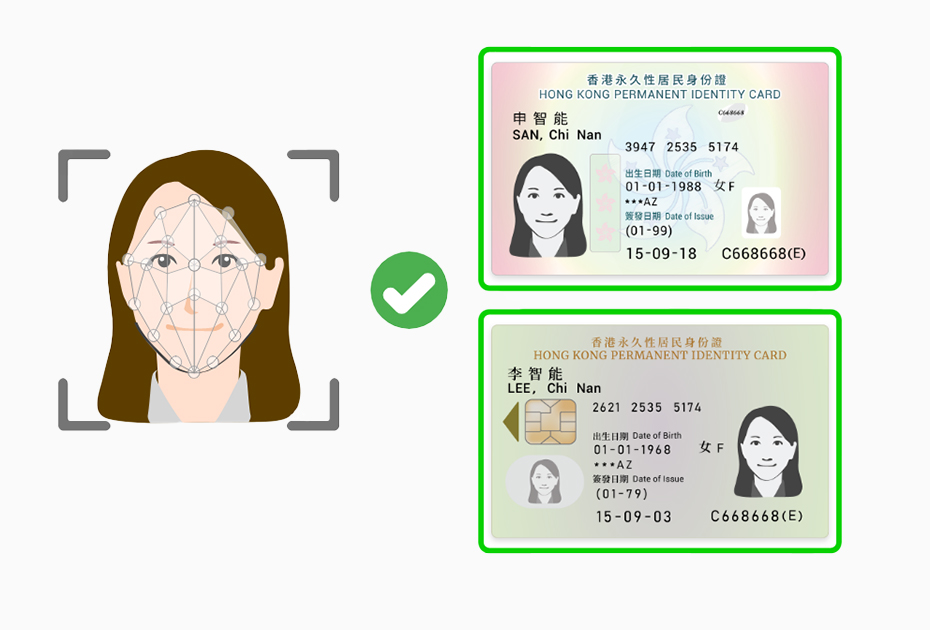

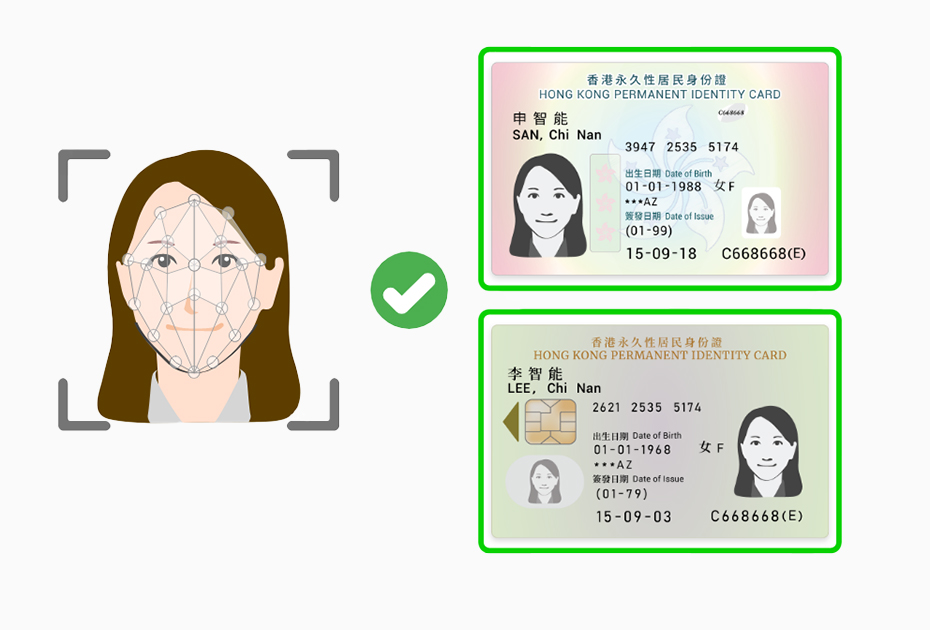

Our solution will be integrated with the client's e-wallet mobile app to enable its end-customers to open an e-wallet account at any time, anywhere in compliance with Hong Kong Monetary Authority's regulations on account opening for Stored Value Facilities. Users can perform ID document verification (support both 2003 & 2018 versions of HKID card) and selfie with liveness detection on their own mobile devices to complete the KYC process for account opening. By automating and streamlining customer onboarding process, our solution helps our client reduce customer acquisition cost while significantly shortening the KYC processing time to just a few minutes.

We are delighted that our eKYC solution continues to gain the trust of financial institutions. Looking forward, we will explore more applications and business opportunities for our eKYC solution in other industries beyond banking and finance.

|

|

Launch of deepfake detection solution

to address growing AI-based identity threats |

To address the growing identity threats from deepfake and generative AI, we have successfully developed a deepfake detection solution following extensive research and development work. We have received significant interest from existing customers who are using our eKYC solution to incorporate our latest deepfake detection solution to further enhance the accuracy of their eKYC process.

Leveraging AI and deep learning technologies, our solution is able to detect AI-generated image, video and audio such as face swaps and voice modification, and accurately determines the authenticity of files. Our solution can achieve an accuracy rate of 98% in deepfake detection while complying with international standards.

Facing the ever-evolving identity security challenges, we will continue to enhance the identity verification capabilities of our solutions, making use of latest technologies such as document anti-counterfeiting and advanced biometrics.

|

|

Completed Smart Point-of-Sale ("PoS") enhancement

to support digital renminbi ("e-CNY") payment |

To help banks and merchants capitalise on the business opportunities brought about by the expansion of e-CNY cross-border pilot program in Hong Kong, we have completed the enhancement of our Smart PoS to support e-CNY payment.

Our enhancement enables Hong Kong merchants to accept e-CNY payments by scanning the QR code from customers' e-CNY wallet using our Smart PoS. The bank will then convert the e-CNY into Hong Kong dollars to facilitate cross-border settlements for merchants. This enhancement provides Mainland Chinese travellers with diverse payment options when spending in Hong Kong; while on the other hand, helps Hong Kong merchants seize business opportunities with the growing number of Mainland Chinese customers.

We will continue to develop any new features thus to enhance the usability and perceived benefits of our Smart PoS.

|